Manufacturing, not online shopping, # 1 in e-commerce

From the U.S. Census Bureau

June 03, 2021

Ask someone to define “e-commerce” and they will likely say, online shopping.

While trading online certainly is one major player in the world of e-commerce – $ 519.6 billion of total retail e-commerce in 2018 – pales in comparison to the proportion of total manufacturing, wholesale and service activity that is done electronically .

Manufacturing companies have embraced e-commerce because it streamlines the process of buying and selling components and products to other companies.

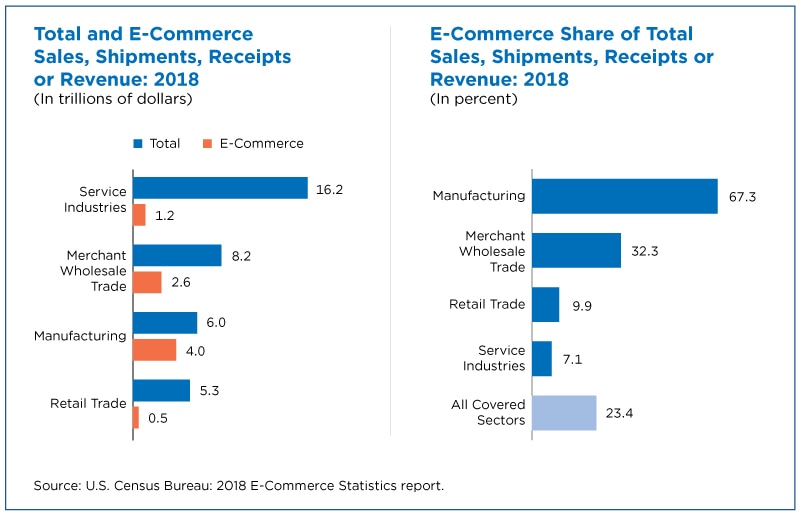

According to the Census Bureau’s 2018 Ecommerce Statistics Report, manufacturing ecommerce shipments accounted for 67.3%, or nearly $ 4.0 trillion, of the total value of manufacturing shipments of $ 6.0 trillion.

By comparison, ecommerce retail sales were only 9.9%, or $ 519.6 billion, of total retail sales of $ 5.3 trillion.

Ecommerce accounted for 23.4% of total sales, shipments, revenue, or sales for any of the four sectors covered in this ecommerce report.

The share of manufacturing e-commerce shipments has been rising steadily for almost two decades.

In 1999, e-commerce represented $ 729.6 billion, or 18.1% of the total manufacturing shipments value of $ 4.0 trillion. By 2018, that proportion had risen to 67.3% and even increased in 2002 and 2009 when the total value of manufacturing shipments and e-commerce shipments declined.

What is Manufacturing Ecommerce?

Just like retail, manufacturing e-commerce involves online customer orders. However, these orders include purchases from both traditional consumers and other domestic operations of the same company, which in turn manufacture, assemble or manufacture the product.

For example, electronic orders for components by an automobile assembly plant at a parts manufacturer of the same company would be counted as manufacturing e-commerce.

Ecommerce can be done over the Internet, but it also includes sales made over extranets, electronic data interchange (EDI) networks, email, or other online systems, and payment may or may not be online.

These platforms can also be used to negotiate the price and conditions for producing e-commerce shipments.

Manufacturing companies have embraced e-commerce because it streamlines the process of buying and selling components and products to other companies.

The automotive assembly industry is a prime example of this.

The industry introduced “just-in-time” production years ago. The components required for car manufacturing are delivered to the assembly plant exactly when they are needed. This helps reduce the need for large inventories of parts and warehouse space to store them.

To make this process efficient, the assembly plant maintains an electronic data exchange with the parts suppliers in order to order parts exactly when they are needed.

Does e-commerce rule all manufacturing industries?

While some manufacturing subsectors dominate e-commerce, almost all of them saw an increase in e-commerce shipments between 1999 and 2018.

For example, papermaking e-commerce shipments rose 66.2% from $ 15.3 billion.

Only two subsectors saw a decrease in e-commerce shipments over the same period. But even then, the share of e-commerce in total shipping increased.

For example, e-commerce shipments from leather and related product manufacturers decreased by 190 million in 1999 between 1999 and 2018.

Similarly, apparel manufacturers’ ecommerce shipments fell by $ 11.4 billion (-69.2%) between 1999 and 2018, but the industry’s share of ecommerce shipments rose from 26.5 % to 51.4%.

The future of e-commerce in manufacturing

Manufacturers have chosen e-commerce for the same reasons they have chosen for the wholesale and service sectors: it enables them to simplify business processes and streamline relationships with downstream customers and upstream suppliers.

Companies supplying inputs to manufacturers do not have to wait for paper order forms to be received and processed. Orders are received electronically and can be processed immediately.

These companies can also plan their transportation systems more precisely. This was especially important during the coronavirus pandemic, when supply chain challenges have often hampered the ability of healthcare providers and emergency managers to respond quickly to the pandemic’s impact on residents and businesses.

These supply chain improvements also cascade downstream: Individuals receive their online orders faster and more accurately.

Most people who rely on online platforms for their retail purchases will likely continue to see retail as a key component of e-commerce, and for good reason: retail e-commerce remains the third largest online sector (519 , $ 6 million in 2018) and online retail sales continued to grow, according to the ecommerce report.

We are grateful for the companies that respond to the many Census Bureau surveys that allow us to measure the impact of e-commerce on critical economic sectors.

Andrew W. Hait is a poll statistician / economist with the Census Bureau.

We need your support!

Your contribution makes community media possible.

Any donation to your nonprofit media organization supports the future of media access in our community – the things you love and the places you care about through the people you know.

Comments are closed.