This woman was charged $10,000 for a 1-mile cab ride in SF. When she challenged the bill, things got even more outrageous

One evening last September, Margarita Bekker and her husband, Chris Schlesinger, got into a San Francisco cab. Her 1.1-mile Yellow Cab ride to a rooftop birthday dinner took 11 minutes.

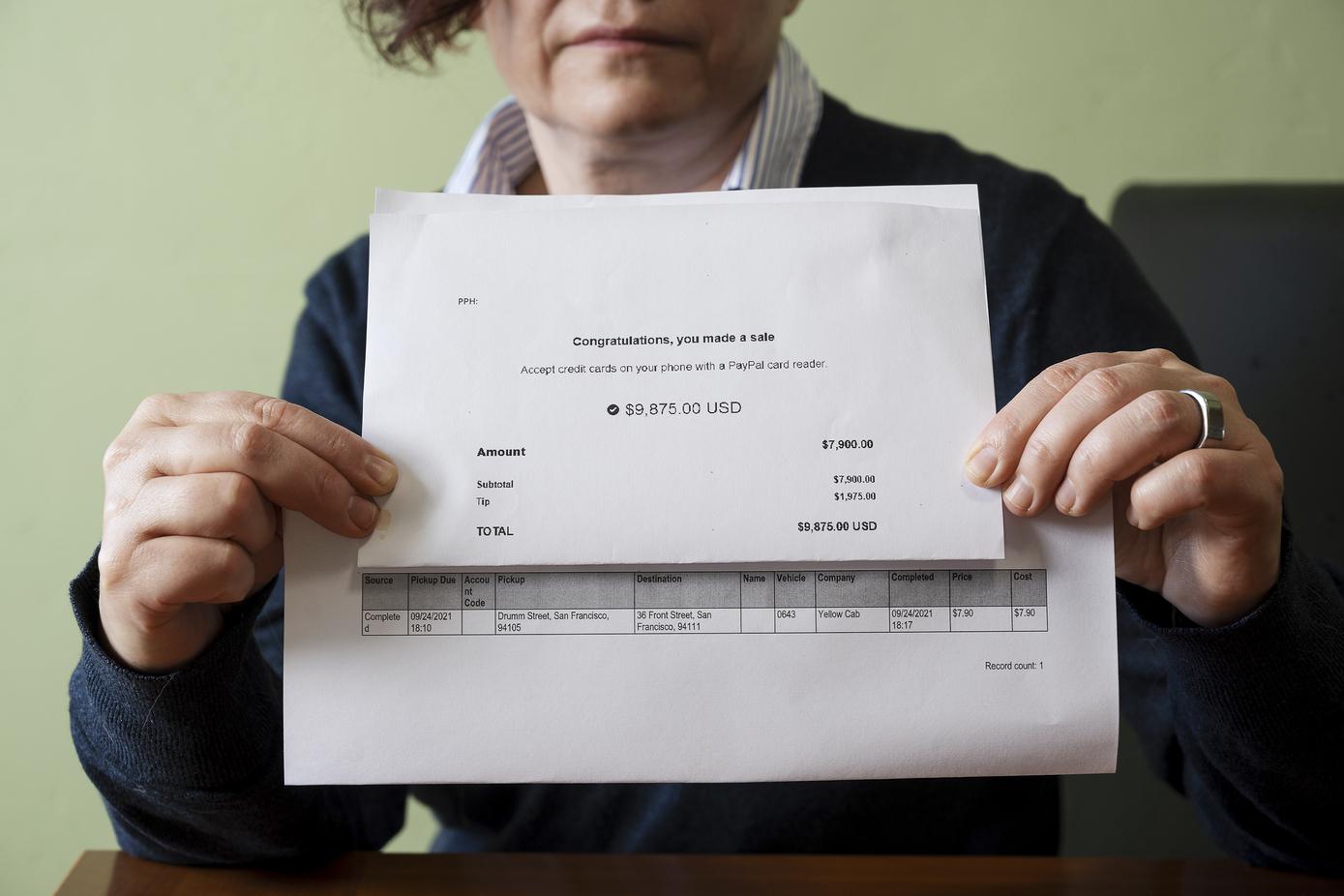

Bekker paid by credit card through the driver’s PayPal terminal after the cab’s built-in device failed to read her card. The taximeter showed a fare of $7.90 and she added a 25% tip for a total of $9.87. The driver said she would receive a receipt via email, which never happened.

A few days later her credit card statement arrived. She was amazed to see that she was billed a whopping $9,875 for this short trip — 1,000 times what it actually cost.

It seemed like an obvious mistake: that the driver must have accidentally or intentionally entered extra digits. She called Bank of America, her credit card issuer, to report fraud. Eventually, the bank said it wasn’t a scam since they offered their credit card themselves, and they had to file a billing dispute, which they did.

“After reviewing the documentation, we found that the amount you were billed was charged correctly,” the bank said in a letter verified by The Chronicle.

In other words, she was on the hook for $9,875.

For Bekker, 51, a Russian immigrant who does medical interpreting at a local hospital, $10,000 is equivalent to three months’ rent and utilities for her home in Redwood City.

Margarita Bekker and husband Chris Schlesinger took a 1.1-mile cab ride from the Powell BART station to a restaurant for his birthday dinner in September and were charged nearly $10,000.

Lance Yamamoto/Special for The Chronicle“It’s going to be essentially like all of my savings,” she said. “I will have no more pillows.”

She called the bank many times, often in tears. Agents told Bekker that the dealer (meaning the taxi driver) said the transaction was legitimate and had a receipt signed by her, even though it didn’t match the signature on her driver’s license.

She started her own research and spent hours on the phone.

“I don’t think the responsibility for the investigation should lie with me,” she said. “(The) logic (of Bank of America) that if a merchant said it wasn’t a scam, it wasn’t a scam, bullies people like me even more.”

She collected many documents. Yellow Cab combed through his computer system and found a record that it was a $7.90 ride. Her Google timeline showed she was only in the car for 11 minutes. The San Francisco Municipal Transportation Agency, which oversees taxis in the city, said it was clearly overpriced and contacted the driver to no avail. PayPal informed her that its only role was to provide the card reader and her credit card issuer would have priority in handling the case.

“It seems like everyone but BofA saw that I was overcharged,” she said. “Even so, the only entity that can do anything is the BofA and they keep telling me that the dealer told them it was a correct charge.”

Jack Gillis, executive director of the Consumer Federation of America, said Bekker was trapped between a rock and a hard spot.

“She did everything right – and still lost,” he said. “It’s very bizarre that the credit card company is going into this, especially when the logic suggests it’s an erroneous charge. Unfortunately, she has very few retreat options. If she doesn’t pay, her credit rating goes down and she gets credit problems.”

To avoid excessive charges, San Francisco taxis are equipped with a built-in payment terminal that is linked to the taximeter. However, the SFMTA also allows drivers to use their own point-of-sale devices as they sometimes get better fees for processing payments. Bekker says she thinks the city should end that policy.

“Obviously it’s a horrific situation for[Bekker]and we feel for her,” said Chris Sweis, Yellow Cab CEO happened,” he said. Excessive fees have been charged on a small scale in the past. In addition to finding the receipt, he called Bank of America on Bekker’s behalf.

The driver, whom The Chronicle doesn’t name because he wasn’t charged with a crime, “was uncooperative” when Yellow Cab asked him to refund the money, Sweis said.

The driver sent a brief reply to an email from The Chronicle, claiming the issue was resolved in December.

Taxi drivers are independent contractors, not employees. The driver had leased a cab and medallion from Yellow Cab for $600 a week for about three months and stopped driving about a week after Bekker’s ride, Sweis said. Like all San Francisco cab drivers, the driver had a permit, which the city issued after a criminal background check.

“This situation should never have happened,” SFMTA spokeswoman Erica Kato said in an email.

Out of 3.5 million trips over the past two years, the SFMTA has received only 26 complaints of overcharging, none for such a large amount, she said. The agency investigates complaints to determine whether disciplinary action is warranted, which could mean a warning or fine for the driver, and suspension or revocation of the driver’s licence. In that case, “disciplinary action will be taken,” Kato said.

After The Chronicle contacted Bank of America, they contacted Bekker and said they decided not to charge her for the money after all.

A bank representative told Bekker and The Chronicle that he had already investigated the issue. Bekker doubts it would have acted without media intervention, noting that she has already spent more than three months calling, emailing, faxing, mailing and tweeting the bank.

In a statement, Bank of America said it investigates disputed transactions and “generally” initiates chargebacks, meaning it withholds disputed funds from a merchant until an investigation is complete.

“However, merchants also have the option of contesting a chargeback,” the bank said. “In this case, the merchant provided us with a copy of a signed receipt for the transaction confirming the amount charged.”

Customers who disagree with their decisions “can request a reconsideration and provide additional information, as the customer did in this case,” the bank said.

Bank of America didn’t respond to questions about why it didn’t flag the unusually large purchase as suspected fraud right away.

Bekker wonders what might happen to others in a similar situation.

“What if I wasn’t so determined; What if I didn’t have the stamina and the English skills and the research skills and the Internet skills? She said. “I would have just been stuck with that bill and it would have wiped out all my savings and then some.”

She trusts people less now. And one thing makes her different.

“I now require paper receipts everywhere,” she said.

Carolyn Said is a contributor to the San Francisco Chronicle. Email: csaid@sfchronicle.com Twitter: @csaid

Comments are closed.